common law marriage colorado filing taxes

It doesnt matter if you and your spouse no longer live under the same roof. For parties to be common law married in Colorado they must meet the following conditions.

New Colorado Law Regarding Joint Filing Of Tax Returns For All Married Couples The Law Office Of Barbara E Cashman

The Court found that filing tax returns as a single person and not taking the surname.

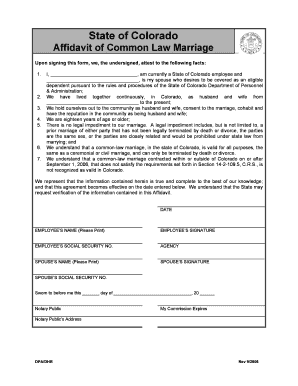

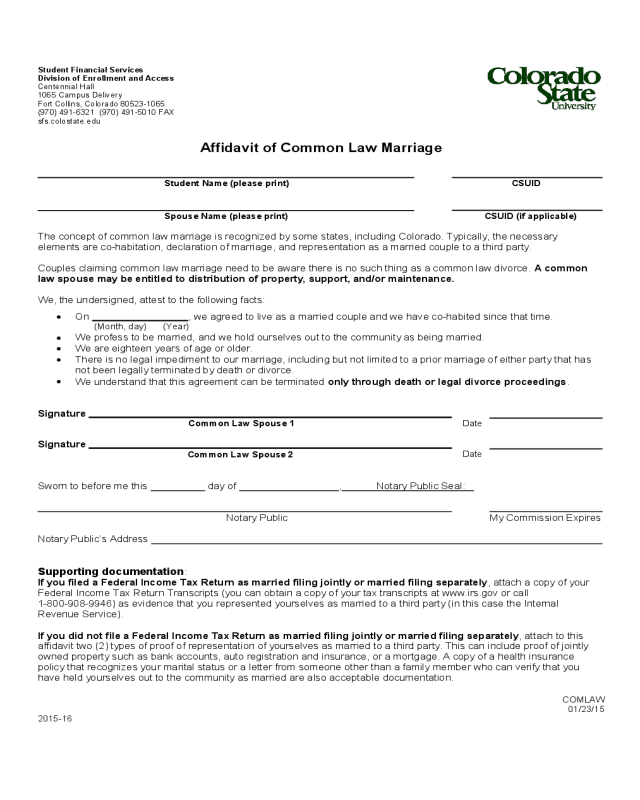

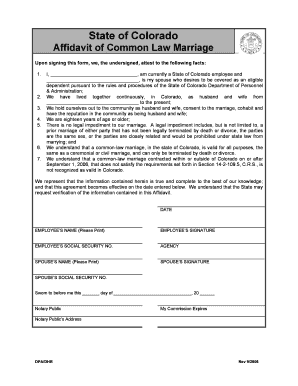

. To record a marriage the parties in a common-law marriage may complete and sign an affidavit of marriage in front of a notary. To prove a common law marriage in Colorado you will need some of the following evidence. The court does not require you to sign an affidavit of common-law marriage in Colorado.

According to Census Bureau data in 2018 15 of people ages 25 to 34 lived together with. 14-2-1095 couples that enter into common-law marriages in Colorado from September 1 2006 have to be at least 18 years of age and satisfy other requirements such as. There is no time requirement for establishing a common law marriage in Colorado.

There is no time requirement for establishing a common law marriage in Colorado. Cohabitation is on a decades-long rise in Colorado and across the country. Court found the evidence was insufficient to prove the existence of a common law marriage.

However to reduce fraud some educational institutions or private. Apart from their personal information they need to mention the name. Common Law Marriage Taxes.

Do You Need an Affidavit of Common-Law Marriage in Colorado. Filing a Joint Tax Return You can file a joint married return if youre legally married on December 31. In colorado it remains one of the indicia of common law.

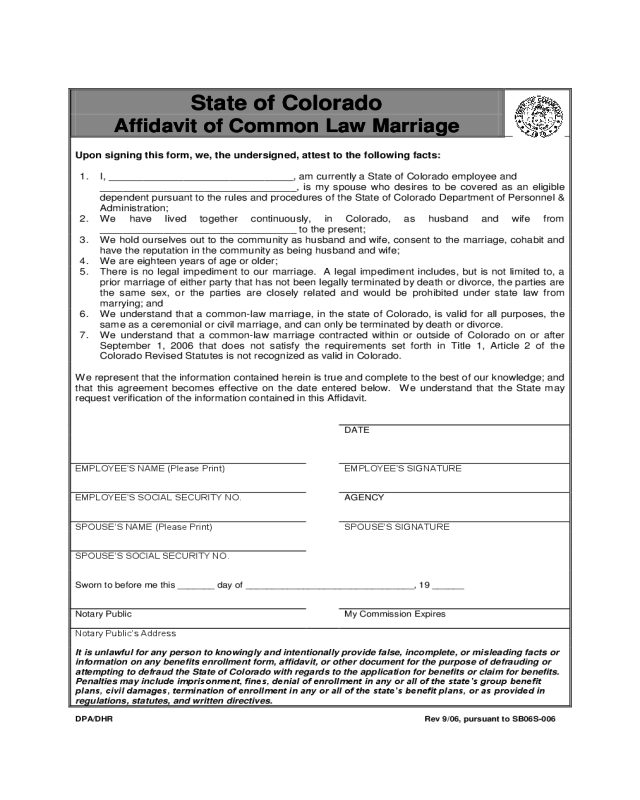

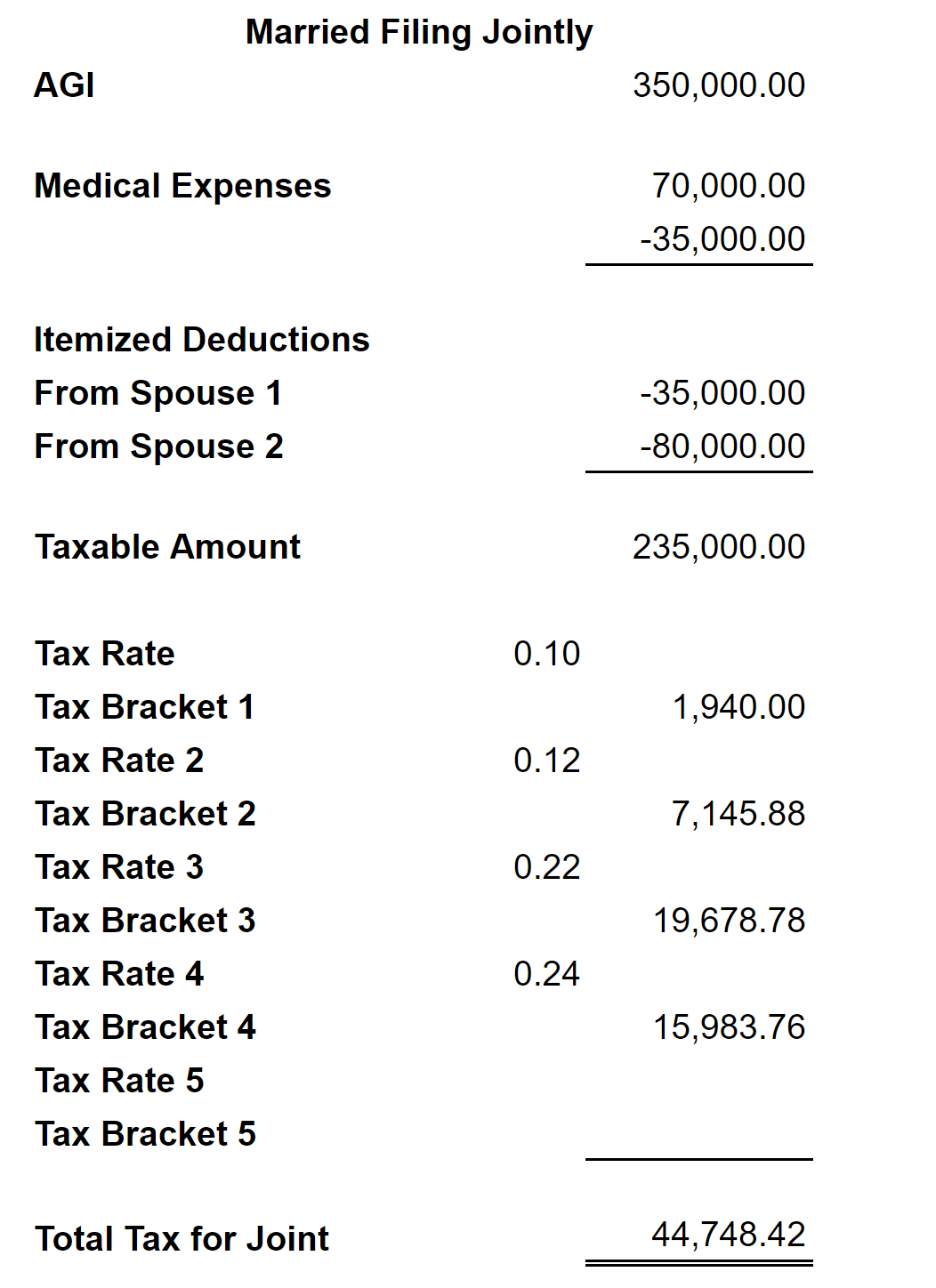

Official verification of a common-law marriage isnt available. Married Filing Jointly is the filing type used by taxpayers who are legally married including common law marriage and file a combined joint income tax return rather than two individual. Update In January 2021 the Colorado Supreme Court reversed the Court of Appeals common law tax filing decision as.

Taxpayers may use the married filing. Filing tax returns as a married couple. February 25 2019.

Both of the common law partners must file their own tax returns with Internal Revenue Service IRS. File income taxes together. Parties agree that they are husband and wife Joint checking or savings account Property.

At aviso law llc our divorce lawyers know the ins and outs of colorado common law marriage. However to reduce fraud some. Parties must both be over 18 years of age see CRS.

A common law marriage could possibly be valid after one day. Alabama Colorado District of Columbia Iowa Kansas Montana Oklahoma Pennsylvania Rhode Island South Carolina and Texas. Taxpayers who live apart but are not.

2022 Affidavit Of Common Law Marriage Fillable Printable Pdf Forms Handypdf

Can A Married Person File Taxes Without Their Spouse

What Is Common Law Marriage In Colorado Cls

Common Law Marriage And Gay Couples In Colorado Sdlgbtn

Irs Common Law Tax Filing Not Conclusive As To Marriage

Denver Common Law Attorney Common Law Lawyer In Denver

State Taxation As It Applies To 1031 Exchanges

Common Law Marriage In Colorado Are You Married Shapiro Family Law

Is Common Law Marriage Recognized In Tennessee

Faqs About Common Law Marriage In Colorado

Marriage Vs Common Law Marriage What S The Difference

Colorado Bigamy Laws Crs 18 6 201

Ask The Taxgirl Filing When Common Law Married

Common Law Marriage In Oklahoma Cannon Law Pllc

Affidavit Of Common Law Marriage Colorado State University Edit Fill Sign Online Handypdf

Same Sex Common Law Marriage Colorado Family Law Attorneys

7 Printable Affidavit Of Common Law Marriage Colorado Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller